Buying your first home is one of the biggest milestones in life—but in Nashville’s fast-paced market, it can also feel overwhelming. The good news? With the right advice (and the right local expert), you can avoid the pitfalls that trip up so many first-time buyers in Music City.

Here are the top 7 mistakes first-time homebuyers make in Nashville—and how to avoid them in 2025.

The Mistake: Touring homes without pre-approval wastes time and can cause you to miss out on homes you love. Sellers in Nashville expect serious buyers to have financing ready.

How to Avoid It: Get pre-approved before you start. It shows sellers you’re a strong buyer and helps you know your price range.

The Mistake: Focusing only on the down payment and forgetting about closing costs, inspections, and property taxes.

How to Avoid It: Budget for 2–5% of the purchase price in closing costs. Property taxes vary by county, so ask your agent to estimate monthly costs in your target area.

The Mistake: Thinking you need 20% down when Nashville has great first-time buyer programs.

How to Avoid It: Research programs like the THDA Great Choice Home Loan Program and ask your lender about down payment assistance.

The Mistake: Waiving inspections to compete in bidding wars. Many older Nashville homes (East Nashville, Sylvan Park) hide costly issues.

How to Avoid It: Always hire a licensed inspector and attend in person. It can save you thousands in unexpected repairs.

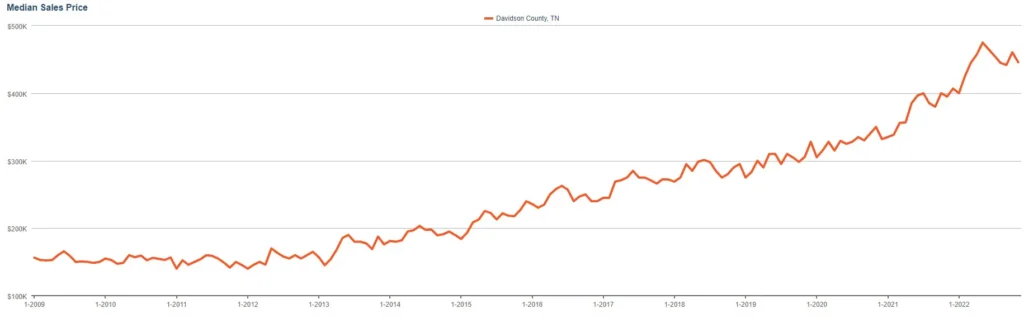

The Mistake: Making decisions based on national headlines instead of Nashville-specific data.

How to Avoid It: Request a current local market report before making offers. Some areas still see bidding wars, others are stabilizing.

The Mistake: Falling in love with the first home you see or overpaying just to win.

How to Avoid It: Separate needs from wants. Create a checklist and stick to your budget—it’s easier to stay level-headed with clear goals.

The Mistake: Thinking you can do this without professional help.

How to Avoid It: Work with a local Nashville realtor who knows the market, negotiates on your behalf, and keeps you protected.

I would love to be there with you every step of the way! William ClenDening

Avoiding these mistakes can save you time, money, and stress. If you’re ready to start your journey, contact me today. I’ll connect you with trusted Nashville lenders, help you find the right neighborhood, and guide you every step of the way..

As of 2025, the median home price in Nashville is around $540,000, but starter homes in areas like Donelson, Madison, and Antioch can often be found at lower price points. Prices vary widely by neighborhood.

Yes! The Tennessee Housing Development Agency (THDA) offers the Great Choice Home Loan Program, which provides down payment assistance. Some local grants are also available in Davidson and Williamson Counties.

In popular neighborhoods like East Nashville, 12 South, and Sylvan Park, multiple-offer situations are still common in 2025. However, other areas may offer more negotiation room. Having a pre-approval is key to standing out.

The biggest mistakes include not getting pre-approved early, underestimating closing costs, skipping the inspection, and letting emotions drive decisions. Working with a local realtor can help you avoid these pitfalls.

Yes. Nashville continues to attract new residents thanks to its strong job market, culture, and lifestyle. Homes in up-and-coming areas like Madison and Donelson are particularly promising for first-time buyers looking to build equity.

Every buyer’s situation is unique. If you’d like personalized guidance or want to know more about Nashville’s current market, I’d be happy to help.

Contact Me Today